Getting The Pvm Accounting To Work

Getting The Pvm Accounting To Work

Blog Article

Top Guidelines Of Pvm Accounting

Table of Contents10 Easy Facts About Pvm Accounting ExplainedExcitement About Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Talking AboutPvm Accounting Can Be Fun For Anyone4 Simple Techniques For Pvm AccountingSome Of Pvm Accounting

Oversee and take care of the production and approval of all project-related payments to customers to cultivate great interaction and prevent issues. construction accounting. Make certain that suitable records and documentation are submitted to and are upgraded with the IRS. Make sure that the accounting process abides by the legislation. Apply called for construction audit requirements and treatments to the recording and reporting of building task.Communicate with various funding agencies (i.e. Title Company, Escrow Company) pertaining to the pay application procedure and requirements needed for payment. Assist with carrying out and keeping inner economic controls and treatments.

The above declarations are intended to describe the general nature and level of work being done by individuals designated to this classification. They are not to be understood as an extensive checklist of duties, obligations, and abilities needed. Employees might be needed to do tasks beyond their regular responsibilities once in a while, as required.

Unknown Facts About Pvm Accounting

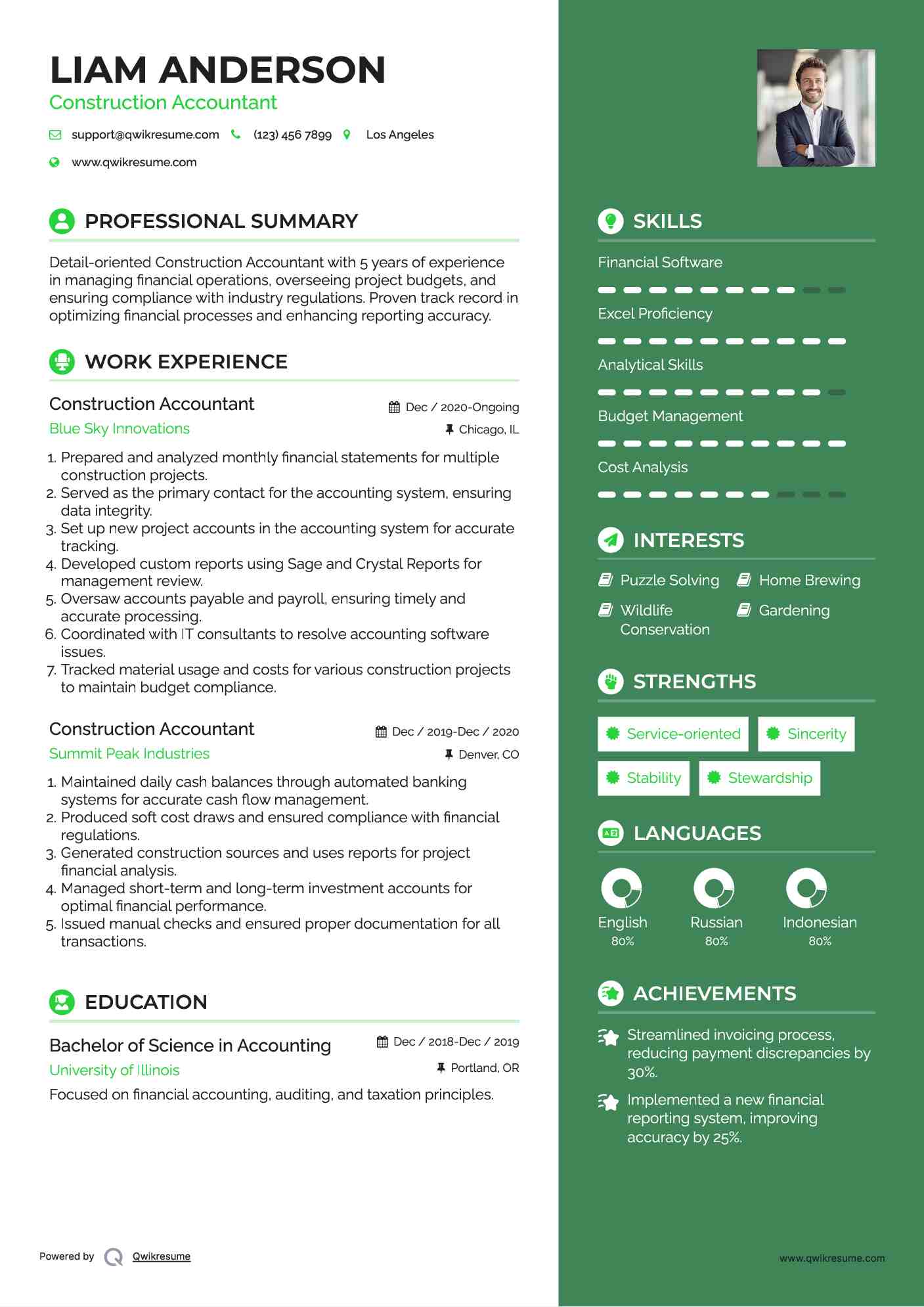

Accel is looking for a Construction Accountant for the Chicago Workplace. The Construction Accountant does a range of accounting, insurance coverage conformity, and project management.

Principal obligations include, however are not restricted to, dealing with all accounting functions of the company in a prompt and accurate fashion and offering records and schedules to the business's CPA Company in the preparation of all monetary declarations. Makes certain that all audit procedures and functions are handled properly. In charge of all economic records, payroll, banking and everyday operation of the bookkeeping feature.

Prepares bi-weekly test equilibrium records. Functions with Task Supervisors to prepare and upload all month-to-month billings. Procedures and problems all accounts payable and subcontractor repayments. Generates monthly wrap-ups for Employees Payment and General Obligation insurance costs. Creates month-to-month Job Cost to Date reports and dealing with PMs to fix up with Project Managers' budget plans for each job.

See This Report on Pvm Accounting

Efficiency in Sage 300 Construction and Actual Estate (formerly Sage Timberline Workplace) and Procore building and construction administration software a plus. https://pubhtml5.com/homepage/ijerc/. Have to likewise excel in various other computer software systems for the preparation of records, spreadsheets and other look at this website audit evaluation that might be required by administration. Clean-up bookkeeping. Need to have strong business skills and capability to prioritize

They are the financial custodians who make certain that building jobs remain on spending plan, abide with tax guidelines, and preserve monetary openness. Building accountants are not just number crunchers; they are calculated partners in the building and construction procedure. Their main duty is to handle the economic aspects of construction projects, ensuring that resources are assigned efficiently and financial risks are decreased.

Top Guidelines Of Pvm Accounting

By maintaining a limited hold on job funds, accountants help stop overspending and monetary setbacks. Budgeting is a foundation of successful construction tasks, and building accounting professionals are instrumental in this regard.

Browsing the complex internet of tax obligation policies in the construction market can be tough. Construction accountants are skilled in these regulations and make certain that the project adheres to all tax obligation requirements. This consists of handling payroll tax obligations, sales tax obligations, and any kind of other tax commitments particular to building. To stand out in the role of a building and construction accountant, individuals require a solid educational foundation in accountancy and money.

Furthermore, certifications such as Certified Public Accounting Professional (CPA) or Qualified Construction Industry Financial Expert (CCIFP) are extremely related to in the industry. Working as an accountant in the building market features an unique set of difficulties. Building jobs usually involve limited deadlines, changing regulations, and unexpected expenses. Accountants should adapt quickly to these challenges to keep the task's economic health and wellness intact.

The Ultimate Guide To Pvm Accounting

Ans: Construction accountants create and keep an eye on budgets, recognizing cost-saving opportunities and making sure that the project remains within spending plan. Ans: Yes, building accountants handle tax obligation conformity for construction tasks.

Introduction to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make difficult selections amongst lots of monetary alternatives, like bidding process on one project over an additional, selecting funding for materials or equipment, or establishing a task's revenue margin. In addition to that, construction is an infamously unstable industry with a high failure price, slow time to repayment, and inconsistent cash flow.

Common manufacturerConstruction company Process-based. Production entails repeated procedures with quickly identifiable costs. Project-based. Manufacturing needs different procedures, materials, and devices with differing costs. Dealt with area. Manufacturing or manufacturing occurs in a solitary (or a number of) controlled places. Decentralized. Each project occurs in a new area with differing site problems and distinct obstacles.

The 8-Minute Rule for Pvm Accounting

Constant usage of various specialty specialists and vendors influences effectiveness and money flow. Repayment gets here in full or with routine repayments for the full contract amount. Some portion of payment may be held back till job completion even when the professional's job is completed.

While typical producers have the benefit of controlled settings and enhanced manufacturing procedures, building and construction business must regularly adapt to each new project. Also somewhat repeatable tasks require alterations due to site problems and other aspects.

Report this page